Accept Direct Debit payments for your subscription business

Gyms, schools, associations. Receiving frequent payments or direct debit subscriptions is easy.

Easypay / Platform / Payment methods / Direct Debit

Direct debit is the simplest way to receive regular payments, such as water bills, electricity, gas, telecommunications expenses, insurance, fees, installments and rent. Provide a more intuitive experience >

Provide a more intuitive experience > >

With a single authorization, your company can receive payments by direct debit on the agreed dates and amounts. As an automated service, it does not require any additional action. See prices >

See prices >

SEPA Direct Debit allows your company to debit payments to any bank account inside the SEPA region.

Get in touch >

Our approach to Direct Debit means you can return funds and change the amounts, billing dates and bank account details.

See how to get started >

Allow your customers to make new payments with a single click. No need to re-enter bank account details

Debit the bank account at any time, after the customer has authorized the SEPA Direct Debit in your online store. .

The donor fills in the bank account information in an easypay form and chooses how often and how much to donate. We automatically charges the amounts on the agreed dates.

Gym, Wine Clubs, and Music on demand. When subscribing to the service, the customer fills in the bank account details in a form or on the SEPA Direct Debit Gateway. On the agreed dates, the bank account is debited for the correct amount.

Water, gas, electricity, telecommunications - The customer fills in the bank account details in a form or on the SEPA Direct Debit Gateway when subscribing to the service. On the agreed dates, we charge the amount due.

Frequently asked questions related to Direct Debit payments.

These are the main advantages of accepting direct debits with easypay

SEPA (Single Euro Payment Area) is a geographic area which includes 36 European countries (with or without the Euro as the official currency). In this space, companies and other agents can make and receive payments in euros (with the same rights and obligations). More information here.

With easypay, you can:

To include a new payment method, you must have contracted it with us:

1) If you are already contracted, you can integrate via API, or if you have the easypay checkout, you can configure it directly, or you can generate payments directly on the Backoffice (see tutorial here).

2) If you don't have it yet, you must send us a request to Correio@easypay.pt, with the subject "Adding Direct Debits" to send you a Proposal for an Amendment to the contract you have with us and be able to start using Direct Debits.

We simplify complexity with efficient payments, simplified management.

Get ready to sell more with our global payment solutions.

Direct Debit is the most suitable payment method for transactions such as Recurring Services, Subscriptions and Donations.

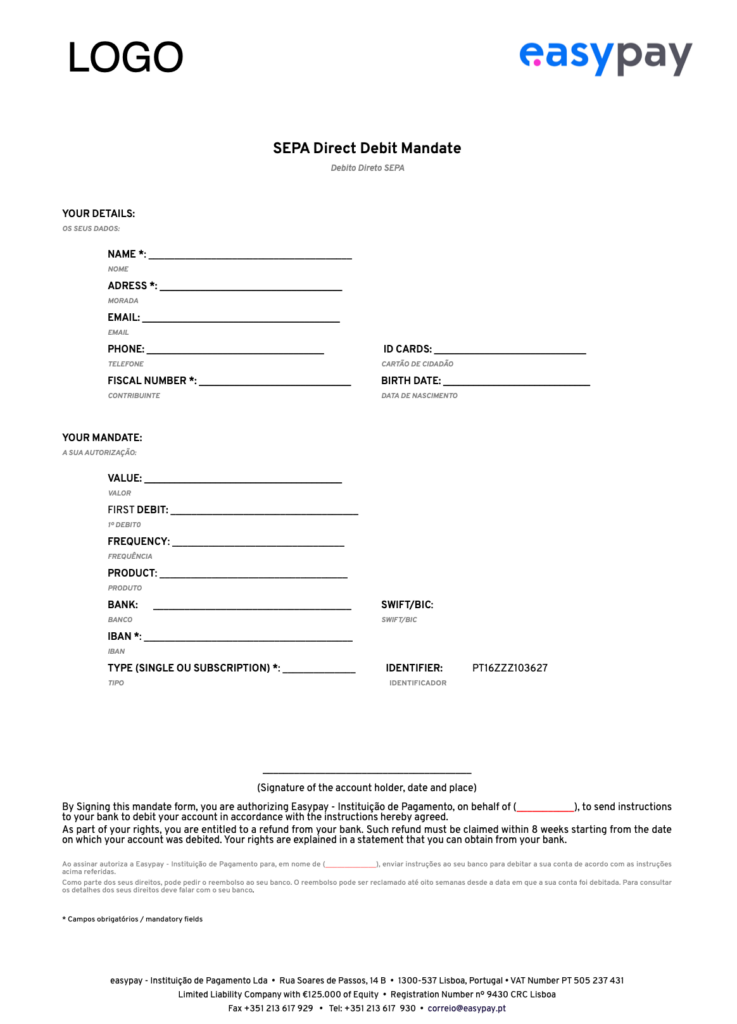

Direct Debit must be instructed by the merchant through a written authorization, known as Direct Debit Mandate where both parties (beneficiary and payer) agree on the collection rules (frequency, value, date of first debit, etc).

This document is the merchant’s responsibility in order to reduce the risk of withdrawal as his customer’s bank may at any time request the Mandate, signed by both parties, to validate the charges. This document must include the following data:

Mandates can be issued in paper or electronic form and must contain the necessary elements to confirm the authorization granted by the payer to the beneficiary, to debit his account, such as the payer’s signature.

Find here the characteristics of easypay’s Direct Debit!