By creating the easypay Payments Account, you have access to the Backoffice. To access the Backoffice you will always have to perform a strong authentication (SMS or App). This procedure is required by the standards of the PSD2 (Payments Service Directive 2) and is intended to ensure that only those who hold the strong authentication factor can access the easypay´s Backoffice. This procedure eliminates, among others, phishing actions.

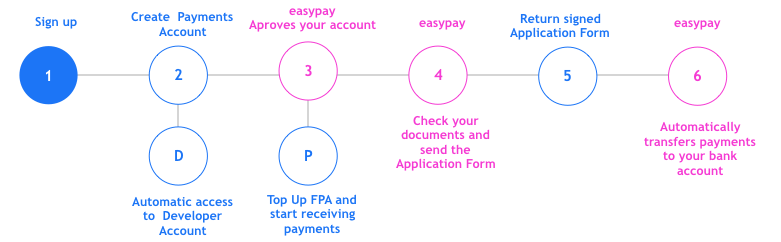

To create your Payments Account:

- Go to easypay ´s website and click on ‘Join easypay‘;

- It takes you to the registration form – please tell if you are joining directly or through a partner and enter your data:

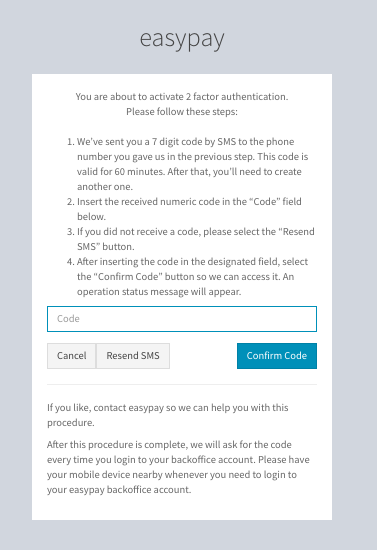

- You will receive a code for strong authentication on your cell phone;

- Enter the code and you will receive and email – follow the instructions.

- From that moment on, you have access to easypay´s Backoffice.

- Login to easypay´s backoffice and fill in the KYC (Know Your Customer) which is required by Banco de Portugal as we are a payment institution (also upload all the required documentation);

- When you finish filling out, click on “Submit”;

- The information will be analyzed to create the Application, which will take some days;

- When creating the Payments Account, you also create a Fee Payments Account – separate account from the Payments Account where easypay fees are debited. The Fee Payment Account is top-up by you and have to be always with positive balance.

- You will receive a confirmation email with instructions to make the 1st charge of the Fee Payment Account;

- From this moment on, you can do the integration process with easypay and start selling;

- You will receive after some days the Application by email to be signed from your side;

- When we receive the signed Application we start transferring the money regularly.

Strong authentication

Strong authentication factor can be by SMS (by default) or by APP. easypay recommends the App as it is the safest factor – see here how to change.

Since 2019, payment service providers (PSP) have had to perform strong authentication of their customers whenever they want to:

- Access your payment account online;

- Initiate an electronic payment.

More information at: https://www.bportugal.pt/page/legislacao-e-normas-dsp2